As we enter 2024, it’s clear that artificial intelligence (AI) remains a key force in transforming different sectors. From cutting-edge AI startups to generative AI and other modeling types, it’s clear that AI technology is here to stay. For organizations aiming to start AI projects or influence AI public policy, it’s crucial to understand and connect with the complex network of agencies, federal procurement, and policy initiatives as the backbone of today’s “AI era.”

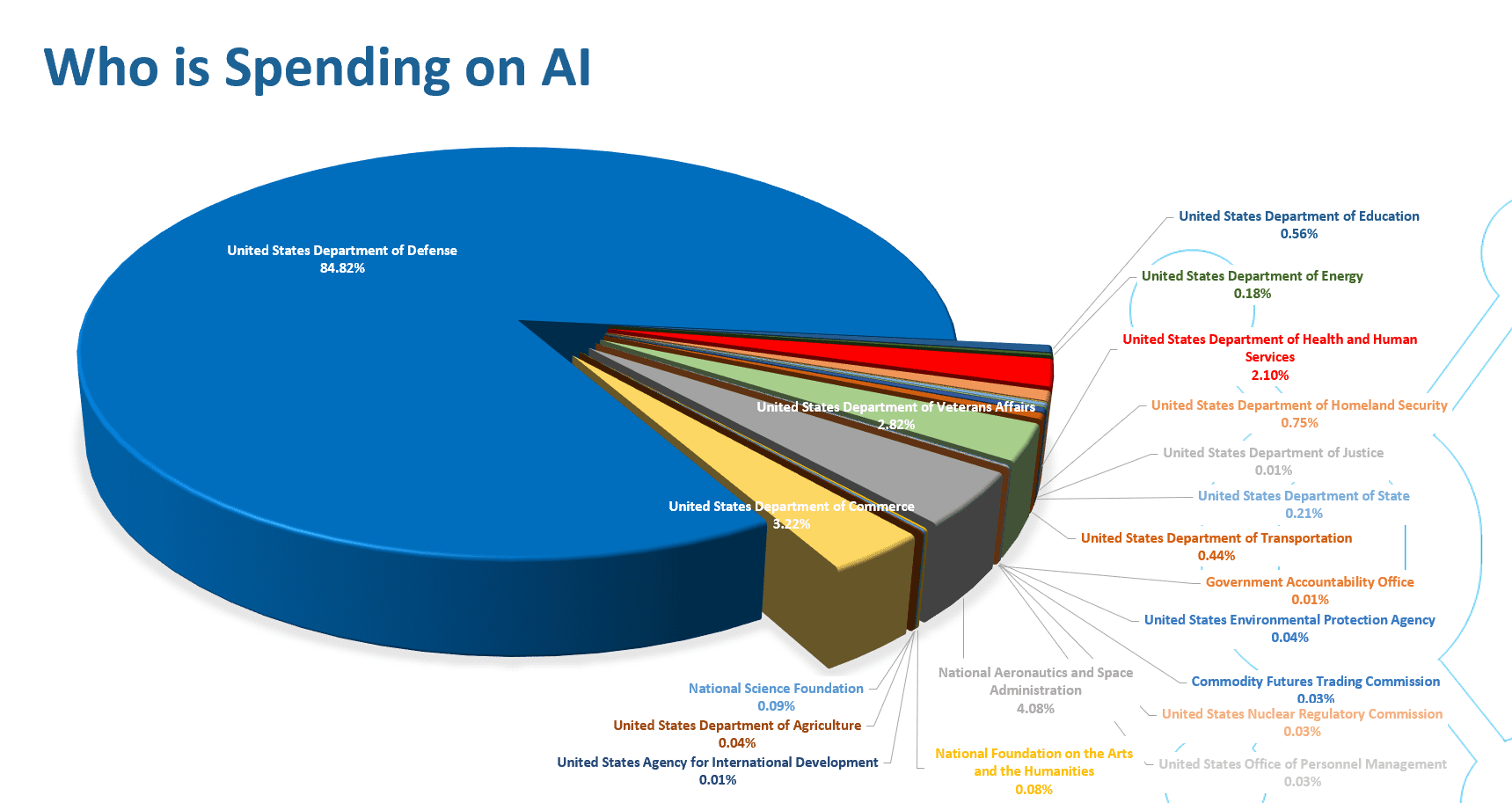

AI Spending: A Government Perspective

Regarding AI goals, a universally shared objective is the innovation of new technologies and leveraging them for broader purposes. For AI startups, the primary aim is innovation, coupled with a focus on growth and scaling for profitability. In contrast, the government also prioritizes new technologies, but with a broader focus on public service enhancement, national security, fostering economic growth, and ensuring regulatory compliance with respect to AI. By investing in entities with similar foundational objectives, government agencies will address their challenges in these areas through federal procurement or programs like SBIR.

The beginning of technology innovation started from an electronic text message transfer, a contract funded by the United States Department of Defense (DoD) called the “ARPANET project,” which is the technical foundation for the internet of today. It is no surprise that the DoD remains a colossus in AI–related projects since our last 2021 analysis. The biggest challenge the DoD continues to tackle is to effectively integrate AI technology into national security and other defense functions. Since 2021, the DoD has expanded on these functions through various singular contracts and contracting vehicles, such as a $250 million AI/ML contract in support of JADC2 capabilities for Palantir in October 2023, in 2022, and a $241 million basic ordering agreement for Morse Corp. and Logistics Management Institute in support of JAIC’s contracting vehicle Data Readiness for AI Data (DRAID). Other agencies have also continually increased their spend in AI contracting to address their challenges through various contracting vehicles and projects, such as NASA SEWP V, NIST (Department of Commerce) AI RMF, and GSA’s Alliant 2.

List of Prominent AI Contracting Vehicles/Programs from Agencies

The Proliferation of AI Vendors and SBIR Awards

As various agencies roll out contract vehicles and programs, we begin to identify the key companies driving the AI era. This sheds light on the difficulties agencies face in AI development, while empowering smaller businesses to develop solutions in contrast with the capabilities of larger federal system integrators.

Small Business Innovation Research program was reauthorized by Congress as part of Biden’s signed SBIR and STTR Extension Act of 2022. As vendors roll in and the data becomes more robust with various AI classification topics, navigating the SBIR terrain and phases for AI development may not be as apparent. For our SBIR analysis, there are three major groups that were taken into consideration. Our topic modeling is comprised of: AI, machine learning, and data science. The visual below associates trending AI topics by spend in SBIR awards that make up the “SBIR AI data.”

Since 2020, there have been 2,021 vendors with active contracts working on an AI project under SBIR. These include AI-focused companies, system integrators, research, and manufacturers.

In comparison to 2020-2021 and 2022-2023, there has been a significant drop of active vendors working on AI projects and AI spend overall under the SBIR program. However, the current SBIR AI vendors remain in the top 100 of Federal AI (not limited to the SBIR program) procurement for agency AI spending. This could suggest that smaller businesses have a healthy spread of investment and projects across different programs/agencies in support of AI innovation and development. Programs under AFWERX and DHS that cater to SBIR qualified vendors and small business set–aside will continue to seek new vendors to work with.

In comparing 2021 to 2024, federal system integrators and AI-focused companies now comprise more than 70% of the federal AI portfolio. Many of these AI-focused companies qualify for small business set-aside and/or have participated in the SBIR program at least once.

The Importance of Inter-Agency Conversations

Leverage Experience and Expertise

Before diving into new AI projects, it’s essential to engage with peers across different agencies. Such dialogue ensures that valuable insights from previous experiences are shared, you avoid duplication of efforts, and foster collaborative innovation. For instance, a small business vendor offering AI solutions and exploring a specific agency’s program must understand the complex network it needs to navigate. This includes progressing from one phase to another in an SBIR program or starting a new project based on past AI work, where connecting influential FSI individuals, program managers, contracting officers, and policy makers may prove useful to streamline procurement lifecycles.

Highlighting Prominent FSI/Small Business, Agency, and Public Policy AI Leaders

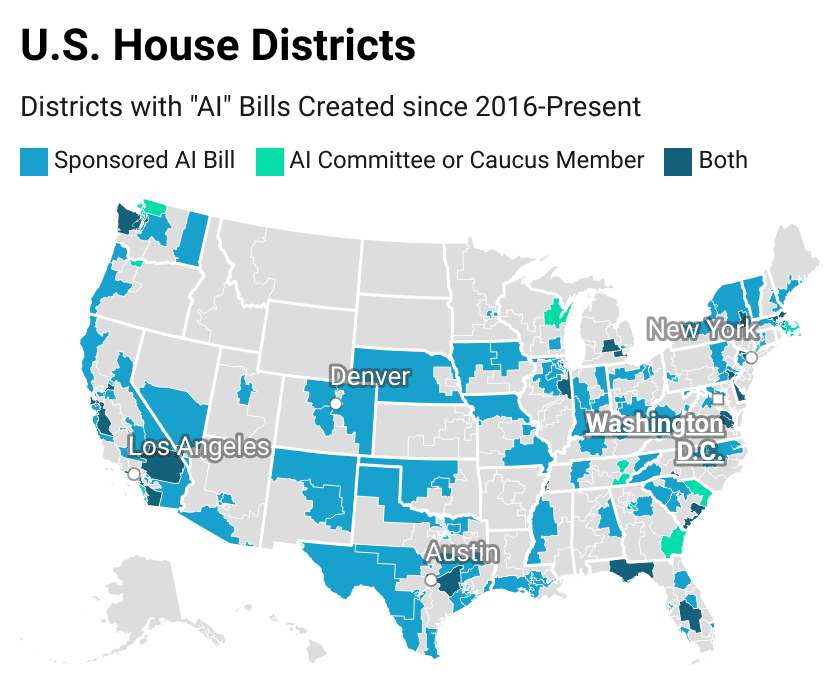

Congressional Leaders Shaping AI Legislation

The Congressional AI Caucus is a strong influence for AI development. However, a majority of this influence comes from outside of this caucus. Below is a District Map of known leaders and staff who have sponsored an AI bill in the past. Leaders and staff comprised a group of more than 187 active influencers on the Hill.

Government Affairs on AI Issues

Lobbyists and other Government Affairs staff act as a bridge between the AI industry and key policymakers. These are the top 150 lobbyists for AI Public Policy, 63 of them are AI vendors within the procurement ecosystem.

List of Lobbyists as a vendor in the AI Federal or SBIR Procurement Ecosystem

| ACCENTURE FEDERAL SERVICES LLC |

| AMAZON WEB SERVICES, INC. |

| ANDURIL INDUSTRIES, INC. |

| ARRAY INFORMATION TECHNOLOGY, INC. |

| AURA TECHNOLOGIES, LLC |

| BAE SYSTEMS INFORMATION AND ELECTRONIC SYSTEMS INTEGRATION INC. |

| BOOZ ALLEN HAMILTON INC. |

| BROWN UNIVERSITY IN PROVIDENCE IN STATE OF RI AND PROVIDENCE PLANTATIONS |

| CALIFORNIA INSTITUTE OF TECHNOLOGY |

| CALYPSO AI CORP |

| CARNEGIE MELLON UNIVERSITY |

| CORNELL UNIVERSITY, INC |

| CROWDAI, INC. |

| DATAROBOT, INC. |

| DELL FEDERAL SYSTEMS L.P. |

| DELOITTE CONSULTING LLP |

| DISCOVERY MACHINE, INC. |

| EPISYS SCIENCE, INC. |

| ERNST & YOUNG LLP |

| FLORIDA INSTITUTE FOR HUMAN AND MACHINE COGNITION INC |

| GENERAL ELECTRIC COMPANY |

| GOOGLE LLC |

| HEWLETT PACKARD ENTERPRISE COMPANY |

| INTERNATIONAL BUSINESS MACHINES CORPORATION |

| IOWA STATE UNIVERSITY EQUITIES CORPORATION |

| JOHNS HOPKINS UNIVERSITY, THE |

| LELAND STANFORD JUNIOR UNIVERSITY, THE |

| LILT, INC. |

| LOCKHEED MARTIN CORPORATION |

| MASSACHUSETTS INSTITUTE OF TECHNOLOGY |

| MICHIGAN TECHNOLOGICAL UNIVERSITY |

| MICRON TECHNOLOGY, INC. |

| MORSECORP, INC |

| NORTHEASTERN UNIVERSITY |

| PALANTIR TECHNOLOGIES INC. |

| PENNSYLVANIA STATE UNIVERSITY, THE |

| POLYSENTRY INC |

| POTOMAC INSTITUTE FOR POLICY STUDIES, THE |

| PRIMER FEDERAL, INC. |

| PURDUE UNIVERSITY |

| RADIANCE TECHNOLOGIES, INC. |

| REBELLION DEFENSE, INC. |

| REGENTS OF THE UNIVERSITY OF CALIFORNIA, THE |

| REGENTS OF THE UNIVERSITY OF COLORADO, THE |

| REGENTS OF THE UNIVERSITY OF MICHIGAN |

| SCALE AI, INC. |

| SHIELD AI INC. |

| SIEMENS CORPORATION |

| SOUTHERN METHODIST UNIVERSITY |

| SPARKCOGNITION, INC. |

| SRI INTERNATIONAL |

| TEXAS A&M UNIVERSITY-CENTRAL TEXAS |

| TORCH TECHNOLOGIES, INC. |

| TRUSTEES OF PRINCETON UNIVERSITY, THE |

| UNISYS CORPORATION |

| UNIVERSITY OF CENTRAL FLORIDA BOARD OF TRUSTEES, THE |

| UNIVERSITY OF ILLINOIS |

| UNIVERSITY OF SOUTHERN CALIFORNIA |

| UNIVERSITY OF UTAH, THE |

| UNIVERSITY OF WISCONSIN SYSTEM |

| UNSTRUCTURED TECHNOLOGIES, INC |

| VADUM, INC. |

| VISIMO LLC |

Our Role in Facilitating Connections and Gateway to AI Contracting Excellence

Our service can provide a way to explore policy and legislation surrounding AI and how it can influence contract vehicles/programs established by agencies. In turn, the goal is to understand an agency’s pains and challenges. With this goal in mind, navigating this extensive landscape can help frame a picture for interagency conversations between the vendor and agency. To explore further and initiate your journey towards AI contracting, SBIR and policy influence, feel free to reach out to us.

FAQs on AI Contracting

Why is it important to consult with peers before starting an AI project?

- Consulting with peers allows for the sharing of insights, which can improve project outcomes and prevent redundant efforts.

How can your service help in finding the right AI key individual?

- Our service provides a comprehensive database of AI vendors and SBIR award details if interested, making it easier to identify potential partners with the desired expertise, their connections, and org display hierarchy charts for agencies.

What makes your service a thought leader in AI contracting?

- We pride ourselves on being at the forefront of connecting people who influence and make AI-buying and -policy decisions. By leveraging our insights and networks, clients can position themselves effectively within the AI marketplace.